Mobile retail apps are the best form of product user acquisition says a report by App Annie.

Apps are the preeminent way for retailers to reach your customers. Whether you are getting consumers to your app, measuring their engagement, encouraging purchases, analyzing their sentiment or expanding to new markets, app data will fuel your mobile success and thereby your company’s success. From competitive benchmarking to international expansion,

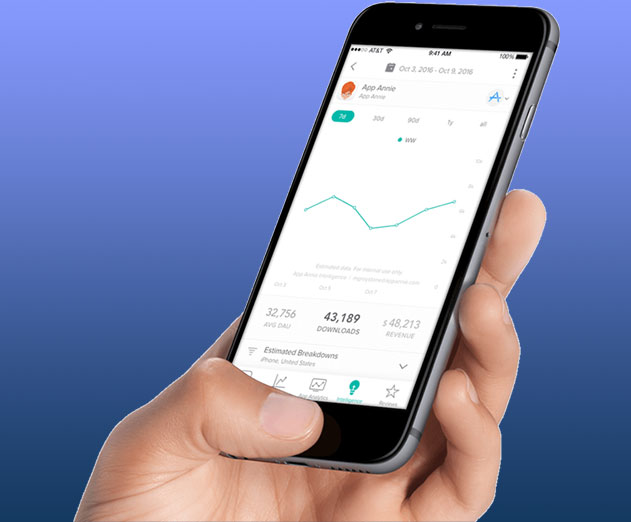

App Annie has delivered new data and insights that show what is needed to succeed in the app economy, so we spoke to Lexi Sydow, Market Insights Manager, App Annie to get more insight.

Sydow: One of the most astonishing findings in this report is that American mobile users spent nearly 50 minutes in shopping apps every month. That adds up to over 600 minutes, or 10 hours, every year in shopping apps alone. As the mobile app economy continues to grow, retailers who get a head start on app development and mobile strategy have the opportunity to grab market share early. From there, retailers can continue to optimize their mobile strategies to maintain momentum through the ongoing mobile evolution. Mobile apps are key to success in retail and should be prioritized as a primary channel to reach customers.

Sydow: The first step to a successful app is building relevant features and a personalized experience. The second is getting users to download the app. Without users, even the best app won't succeed. Therefore, User Acquisition (UA), should be an active and ongoing effort, not a passive exercise.

Secondly, it's important to notes that Digital-First retailers exceeded Bricks-and-Clicks retailers in average sessions per user and therefore generated more revenue opportunities each month. Bricks-and-Clicks apps need to focus their attention on increasing their sessions per user in order to increase their top line.

Lastly, increasing browsing capabilities, loyalty programs and product recommendations can increase the time spent per user in-app which can have a material impact on a retailer's top line. Having a trusted app partner can help app developers identify the key strategies that will help them to achieve their specific goals and drive ROI.

Sydow: This data pinpoints where customers are spending the most time in apps. It also gives an idea of where the industry is going. For example, we predict that we will see an increase in app-only or app-exclusive deals this Black Friday and Cyber Monday. Companies that are adopting these types of strategies have the advantage of preparing their app ahead of time for the holiday traffic. To truly be successful in the long term, businesses need to stay mindful of what their competitors are doing and constantly monitoring trends and adjusting their engagement tactics throughout the app's lifetime. The data from this report allows retailers to accurately measure customer satisfaction and implement changes to reflect customer demand. Additionally, these insights help brands benchmark against competitors in order to incorporate best practices that move the needle on critical engagement metrics affecting basket size and lifetime value.

Sydow: Consumers are now spending more time on mobile than they were five years ago. In fact, global downloads of Shopping apps grew 20% year over year in H1 2017 across both iOSand Google Play, and the average Android phone user spent a minimum of 35 minutes across Shopping apps each month in H1 2017 among countries analyzed in this report, with South Korean consumers leading the pack at nearly 100 minutes spent in shopping apps each month. In the past five years, more companies have created mobile apps to engage and retain customers. This data shows that the app economy is gaining speed, not only for retailers but also app developers at large. No matter where you are on the path to mobile, data is imperative to fueling success. Also, having a reliable partner who can share insights and best practices on the industry and competitive landscape can help a business stay ahead of competitors and keep their mobile momentum strong.

Sydow: The unique advantage retail apps have is the intimate, direct channel they provide for customers and their ability to bridge the online and offline world. Increasingly apps are being used to create a more meaningful and fulfilling experience in-store. Additionally, retail apps have a wealth of data including past purchase behavior, abandoned cart data and information on consumer wish lists and favorite products. This enables retailers to push out specific product recommendations and foster brand loyalty. Retail apps also create an immersive and personalized shopping experience for each user, representing a massive opportunity for brands to reach, influence and convert shoppers. More so than any other app category, retail apps have the opportunity build true brand engagement and offer the ability for retailers to create seamless touch points between brand and consumer.

Sydow: One challenge retail apps will struggle with is trying to set themselves apart from other apps. In a saturated market, retailers need a solid app strategy to ensure they're attracting and retaining customers. Retailers must continuously be examining app analytics to determine how people are using their app and what features are most valuable to these users. This information in turn influences how they measure success, whether it is sessions per user, total time in-app or ratings and reviews. This report specifically highlights how cross-app usage can shed light on users' preferences and affinities and in turn better inform User Acquisition (UA) techniques, tips for competing with Digital-First retailers, and details on how particular companies have used mobile to expand their footprint globally. As the retail industry continues to innovate to stay relevant, creating a strong mobile app can easily become the cornerstone of retailers' overall strategy for success.

Sydow: Consumers today are on track to spend well over 1 Trillion hours using apps in 2017, as more and more functions migrate to mobile (banking, video streaming, dating, etc.). A greater portion of people's lives are being integrated into smartphones (e.g. shopping, banking, paying, dating, music streaming, communication, ride-sharing, etc). As a result, people are using more apps each month and spend more time in apps to complement their daily activities. When it comes down to shopping, consumers are spending more time in-apps to both browse, collate wish lists and ultimately make purchases. Each app session, whether to browse products, unlock deals, access loyalty programs or order a product, ultimately drives the consumer one step closer to purchase.

ADM: What is the most interesting or thought-provoking finding in this report?

Sydow: One of the most astonishing findings in this report is that American mobile users spent nearly 50 minutes in shopping apps every month. That adds up to over 600 minutes, or 10 hours, every year in shopping apps alone. As the mobile app economy continues to grow, retailers who get a head start on app development and mobile strategy have the opportunity to grab market share early. From there, retailers can continue to optimize their mobile strategies to maintain momentum through the ongoing mobile evolution. Mobile apps are key to success in retail and should be prioritized as a primary channel to reach customers.

ADM: What are the three most important things that app developers can take from this report?

Sydow: The first step to a successful app is building relevant features and a personalized experience. The second is getting users to download the app. Without users, even the best app won't succeed. Therefore, User Acquisition (UA), should be an active and ongoing effort, not a passive exercise.

Secondly, it's important to notes that Digital-First retailers exceeded Bricks-and-Clicks retailers in average sessions per user and therefore generated more revenue opportunities each month. Bricks-and-Clicks apps need to focus their attention on increasing their sessions per user in order to increase their top line.

Lastly, increasing browsing capabilities, loyalty programs and product recommendations can increase the time spent per user in-app which can have a material impact on a retailer's top line. Having a trusted app partner can help app developers identify the key strategies that will help them to achieve their specific goals and drive ROI.

ADM: With the industry becoming more and more complex every day, how can businesses use this data to build a better app that stands out against the competition?

Sydow: This data pinpoints where customers are spending the most time in apps. It also gives an idea of where the industry is going. For example, we predict that we will see an increase in app-only or app-exclusive deals this Black Friday and Cyber Monday. Companies that are adopting these types of strategies have the advantage of preparing their app ahead of time for the holiday traffic. To truly be successful in the long term, businesses need to stay mindful of what their competitors are doing and constantly monitoring trends and adjusting their engagement tactics throughout the app's lifetime. The data from this report allows retailers to accurately measure customer satisfaction and implement changes to reflect customer demand. Additionally, these insights help brands benchmark against competitors in order to incorporate best practices that move the needle on critical engagement metrics affecting basket size and lifetime value.

ADM: How has the global mobile competitive landscape changed for businesses over the past 5 years?

Sydow: Consumers are now spending more time on mobile than they were five years ago. In fact, global downloads of Shopping apps grew 20% year over year in H1 2017 across both iOSand Google Play, and the average Android phone user spent a minimum of 35 minutes across Shopping apps each month in H1 2017 among countries analyzed in this report, with South Korean consumers leading the pack at nearly 100 minutes spent in shopping apps each month. In the past five years, more companies have created mobile apps to engage and retain customers. This data shows that the app economy is gaining speed, not only for retailers but also app developers at large. No matter where you are on the path to mobile, data is imperative to fueling success. Also, having a reliable partner who can share insights and best practices on the industry and competitive landscape can help a business stay ahead of competitors and keep their mobile momentum strong.

ADM: What unique advantage or opportunities do retail apps have over other categories in the industry? (i.e. gaming or social apps)

Sydow: The unique advantage retail apps have is the intimate, direct channel they provide for customers and their ability to bridge the online and offline world. Increasingly apps are being used to create a more meaningful and fulfilling experience in-store. Additionally, retail apps have a wealth of data including past purchase behavior, abandoned cart data and information on consumer wish lists and favorite products. This enables retailers to push out specific product recommendations and foster brand loyalty. Retail apps also create an immersive and personalized shopping experience for each user, representing a massive opportunity for brands to reach, influence and convert shoppers. More so than any other app category, retail apps have the opportunity build true brand engagement and offer the ability for retailers to create seamless touch points between brand and consumer.

Lexi Sydow, Market Insights

Manager, App Annie

Manager, App Annie

ADM: What will be the biggest challenge for retail apps this holiday season?

Sydow: One challenge retail apps will struggle with is trying to set themselves apart from other apps. In a saturated market, retailers need a solid app strategy to ensure they're attracting and retaining customers. Retailers must continuously be examining app analytics to determine how people are using their app and what features are most valuable to these users. This information in turn influences how they measure success, whether it is sessions per user, total time in-app or ratings and reviews. This report specifically highlights how cross-app usage can shed light on users' preferences and affinities and in turn better inform User Acquisition (UA) techniques, tips for competing with Digital-First retailers, and details on how particular companies have used mobile to expand their footprint globally. As the retail industry continues to innovate to stay relevant, creating a strong mobile app can easily become the cornerstone of retailers' overall strategy for success.

ADM: Why do you believe increased time in app leads to more dollars spent?

Sydow: Consumers today are on track to spend well over 1 Trillion hours using apps in 2017, as more and more functions migrate to mobile (banking, video streaming, dating, etc.). A greater portion of people's lives are being integrated into smartphones (e.g. shopping, banking, paying, dating, music streaming, communication, ride-sharing, etc). As a result, people are using more apps each month and spend more time in apps to complement their daily activities. When it comes down to shopping, consumers are spending more time in-apps to both browse, collate wish lists and ultimately make purchases. Each app session, whether to browse products, unlock deals, access loyalty programs or order a product, ultimately drives the consumer one step closer to purchase.