In the 1980’s, restaurants used just three marketing channels: phone, postal mail and print ads for promoting their brick and mortar stores. Rapid progress in consumer tech has brought many new opportunities to reach customers today, via new personal mobile devices and marketing channels, including email, websites, and mobile apps. As consumers began to use multiple devices and different channels, restaurants faced the perplexing problem of how to make sure that all these channels communicate and complement each other to give people the smoothest experience. To meet the challenge, some businesses developed a multichannel marketing strategy.

The 2000’s Multichannel Marketing

The different channels in a multichannel approach include SMS text messages, email and postal mail, and even plastic cards as a customer loyalty and discount tool. As a part of this strategy, consumers use many different channels to connect with a brand. However, the channels are not combined and are utilized separately by restaurants, and sometimes by different teams.

For example, a brand uses web-based ordering, sends emails and text messages, and then offers plastic loyalty cards. This approach has its obvious advantages, such as creating multiple interactions to reinforce a brand message. However, it requires a lot of effort from the marketing team to keep all the wheels turning. They need to orchestrate different marketing channels and micro-campaigns and synchronize all touch points with their customers to effectively engage them. Might there be a better way?

It’s 2017: Time for a Mobile-First Focus

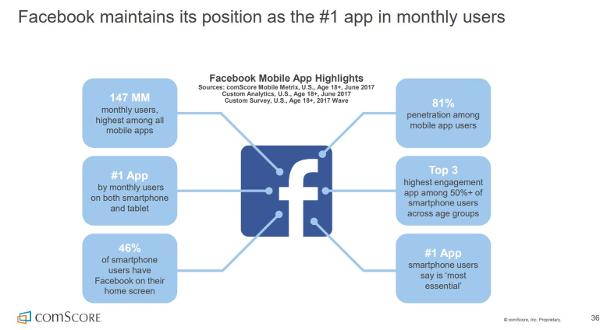

According to comScore’s recent Cross Platform Future in Focus report, in the U.S. the average adult (18+) spends two hours, 51 minutes on their phones per day. Many of today’s younger consumers, particularly Millennials and Generation Z, use their smartphones for almost everything — searching for nearby restaurants, looking through menus, checking reviews, hunting for special offers, making orders and payments. That is why restaurant owners want to get their messages front and center with the smartphones their customers have in their hands.

Instead of using multiple marketing channels, brands can converge to mobile, and switch to a “all in one” mobile app solution. Businesses in the quick-service restaurant industry have started following the mobile trend and are launching their own apps, realizing that a well-planned mobile strategy can help them boost company’s profits through more effective customer engagement that they can track.

The Power of the Integrated Mobile App Channel

In case you are not sure why it’s worth making mobile your primary customer communication channel, instead of using multiple marketing channels for different goals, here are six benefits of going down the path of mobile-first focus.

'The Brand in their Hand'

Everybody has a smartphone, and they bring it with them, making it a highly personalized tool. With a mobile app installed on your customer’s phone, you can have the “brand in their hand.” In terms of brand awareness, an app is more efficient, as compared to the a website, because it provides the easiest way of exposing consumers to your brand at least once a day. People may not even use your app every single day, but as long as they have your app installed, it serves as a constant reminder of your brand, since they see your app icon almost every time they use their smartphones.

Everybody has a smartphone, and they bring it with them, making it a highly personalized tool. With a mobile app installed on your customer’s phone, you can have the “brand in their hand.” In terms of brand awareness, an app is more efficient, as compared to the a website, because it provides the easiest way of exposing consumers to your brand at least once a day. People may not even use your app every single day, but as long as they have your app installed, it serves as a constant reminder of your brand, since they see your app icon almost every time they use their smartphones.Right Message, Right Time, Right Place

Only a mobile app provides marketers with the opportunity to connect with their customers at the right time, in the right place, via the individual message. If done right, push messaging can lead to 10-50 percent conversion from your hyper-targeted campaign. With push messages, you can inform your guests about special offers in your restaurant, send them birthday greetings, and offer some incentives, encouraging them to visit your place.

According to the survey done by Responsys, nearly 70 percent of consumers enable push notification from their favorite brand’s apps. With web-based communication, emails are often read at the wrong time. What is more, mobile apps have opened new frontiers in location-based marketing. Due to geo targeting, you can communicate with your customers based on their geolocation.

Data Collection

A mobile app allows you to collect priceless data about your customers to get insights into their demographics, behavior, habits, and preferences. With this wealth of information you can segment your guests and send them targeted messages. With an integrated mobile app solution, all data is collected in one place, eliminating the need to synchronize all data that is acquired from many channels.

New Stream of Conversions

Mobile apps provide a great medium to push users down the conversion funnel. As mobile apps allow to run more targeted campaigns, marketers can use apps to tap specific users in the funnel. In the retail industry, app mobile shoppers are more engaged and are more likely to convert than web-based users. According to Criteo’s Q4 2015 State of Mobile Commerce Report, app-conversion rates were 120 percent higher than mobile browser conversions and 20 percent higher than desktop conversions. Restaurant owners can take advantage of an app-centric mobile strategy as well. By implementing an in-app ordering feature, you can provide a more convenient experience to your guests and enable them to make orders on the go. Consumers who make orders online tend to purchase more, since they have more time to decide.

The True Value of Loyalty

With all that noise out there, including flyers, coupons, billboards, website banners, social media ads, and emails, businesses are losing their influence on customers who have very low patience and short attention span. Therefore, it can be very hard to reach out to them through the large amounts of advertising. On the other hand, most customers are welcoming mobile app loyalty programs. These programs don’t involve a time-consuming process of registration and take up additional space in your wallet, pocket, or purse, as opposed to plastic loyalty cards. Mobile app loyalty programs encourage your customers to spend more. Only a mobile app provides your guests with the easiest way to purchase items right after receiving the personalized reward. When a special offer is delivered via the push message to your client’s mobile app, they have it right at their fingertips and are just one click away from using this offer in-store.

With all that noise out there, including flyers, coupons, billboards, website banners, social media ads, and emails, businesses are losing their influence on customers who have very low patience and short attention span. Therefore, it can be very hard to reach out to them through the large amounts of advertising. On the other hand, most customers are welcoming mobile app loyalty programs. These programs don’t involve a time-consuming process of registration and take up additional space in your wallet, pocket, or purse, as opposed to plastic loyalty cards. Mobile app loyalty programs encourage your customers to spend more. Only a mobile app provides your guests with the easiest way to purchase items right after receiving the personalized reward. When a special offer is delivered via the push message to your client’s mobile app, they have it right at their fingertips and are just one click away from using this offer in-store. Social Sharing

You can integrate social media platforms into your restaurant’s app to collect more reviews that your happy customers leave. It’s a great opportunity to leverage word-of-mouth marketing and accumulate social proof around your brand by getting people to share their positive experience on social networks. To encourage your guests to recommend your brand, you can give them additional rewards points for that. Also, you can add an ability to share content from your app news feed on social media directly from the app.

The Future of Mobile Apps

The explosive growth in the mobile app market isn’t likely to end. More restaurants are jumping on the mobile app bandwagon to make sure their guests have a convenient, fast, and pleasant experience, when making a purchase.A key advantage of a mobile-first strategy is that it allows for a consistent communication through just one channel, which is beneficial for both your customers and your restaurant. It is difficult to provide your clients with the same experience though different marketing entities. You need to make sure that every channel you use delivers a message that effectively engages your audience. Using multiple marketing channels lead to increased cost and difficulties of determining which channels and campaigns contributed to conversions and sales. On the other hand, with an integrated mobile app solution, restaurant owners don't have to spend a large amount of financial, time, and human resources to manage and coordinate different channels and measure the results.