If there’s one company that’s emblematic of the evolving state of mobile marketing in 2016, it’s Snap – as the still-freshly-rechristened Snapchat would now prefer you call them. The story of the firm’s changing role in the mobile marketing ecosystem is one of the most interesting developments of the last 12 months, and reflects wider trends that have shaped the industry this year.

For most of 2015, the app was a buzz-worthy phenomenon, but was still largely considered a plaything for millennials by the mobile marketing industry. There was interest surrounding the app, particularly given its video-heavy format and command of young consumers’ eyeballs, but brands were for the most part unsure how to manage a marketing channel where your adverts would disappear after a single viewing.

That uncertainty began to change over the course of 2015 and towards the end of the year, Snapchat reached out to brands and marketers in the form of new Sponsored Lenses and Filters. This function, only recently introduced to the app at the time, used face-tracking technology to place effects over the top of images, and was a runaway hit with users. With the Sponsored version, brands could create their own filters which, if they appealed to Snapchat’s users, could be shared millions of times organically.

By the end of 2015, the first few Sponsored Lens campaigns had been run by brands in both the US and UK, and the stage was set for 2016 to be the year that Snapchat and mobile marketing truly embraced each other.

Snapping Into The ZeitgeistIn the same way that Twitter has seen its fortunes stall and stumble as its precipitous user growth slowed to a crawl, much of Snapchat’s popularity among marketers and brands can be attributed to its phenomenal rate of growth.

Snapping Into The ZeitgeistIn the same way that Twitter has seen its fortunes stall and stumble as its precipitous user growth slowed to a crawl, much of Snapchat’s popularity among marketers and brands can be attributed to its phenomenal rate of growth.

Figures provided to Mobile Marketing by a Snap spokesperson show that over the course of 2016, the app has gone from over 7bn videos viewed daily to more than 10bn. The app boasts 150m daily active users, with 50m in Europe and over 10m of those in the UK.

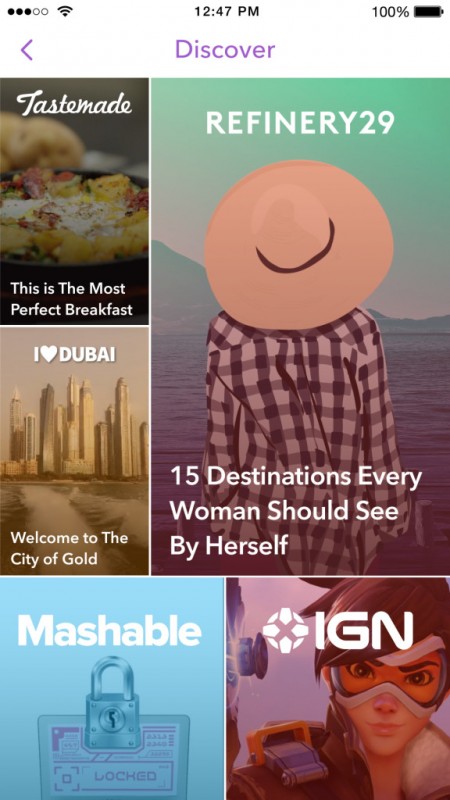

As 2017 unfolded, Snap wasn’t afraid of making big moves that took advantage of its status as the ‘hot new app’. It dramatically expanded its existing deals with Comedy Central and NBCUniversal in order to populate its Live Stories section with premium sponsored content and exclusive video, and brought in new top-flight brands for campaigns.

The immediacy of the app and its video formats also lent itself to sports coverage: the firm signed up an array of high-profile brands including Amazon, Pepsi, Budweiser and Marriott for its Super Bowl Live Story, and even convinced Major League Baseball to relax its strict rules about social media in the dugout to provide fans with a glimpse behind the scenes during spring training.

Those two events, among others, provided Snap with plenty of practice when it came to covering sporting events, experience it used to draw a huge audience during the Rio 2016 Summer Games. Almost a third of its daily users, just under 50m people, viewed Olympics coverage within the app’s Live Stories feature, which was provided through partnerships with broadcasters including NBC and the BBC. Snapchat’s Olympic numbers rivalled Facebook and Twitter, and showed that the app had truly arrived in terms of commanding a massive audience of users.

Connecting with Marketers

These large-scale partnerships and impressive numbers meant that brands and marketers were more eager than ever to partner with Snap, and the company was just as eager to help them do so. Over the course of the year, it introduced new targeting capabilities aimed at improving results and enabling marketers to more easily tie Snapchat campaigns into their multi-channel efforts, and expanded its ad formats to include app install ads for a limited number of partners.

These large-scale partnerships and impressive numbers meant that brands and marketers were more eager than ever to partner with Snap, and the company was just as eager to help them do so. Over the course of the year, it introduced new targeting capabilities aimed at improving results and enabling marketers to more easily tie Snapchat campaigns into their multi-channel efforts, and expanded its ad formats to include app install ads for a limited number of partners.

Perhaps most crucially, though, the firm unveiled Snapchat Partners. The long-awaited release of its advertising API enabled ads on the app to be sold by third parties, and establishing a full-blown advertising platform to underpin its growing marketing efforts.

Snapchat Partners established a set of creative agencies who were deemed to have expertise in the app’s vertical video formats, and began partnerships with a number of ad tech firms who were authorised to develop software for buying, optimising and analysing campaigns run through Snapchat.

At the beginning of 2016, while Snap had started to work with brands and agencies to create native campaigns, it was still early days, with many marketers hesitant over the lack of analytics and reporting offered by the company. Fast forward 12 months, and Snap now offers 15 measurement and optimisation solutions designed by companies including Google DoubleClick, Nielsen, Sizmek, AppsFlyer and Oracle.

This increased support for marketers meant that Snap reported significant growth across all three of its primary ad units for the year. Sponsored Lenses and Sponsored Geofilters (which were available only in certain locations) all saw more activity over the course of the year, and the newly-introduced Snap Ads, which placed vertical video ads between Live Stories sections, proved a success right from the word go.

A Different Kind of Platform

While Snapchat may have started reaching out to marketers in traditional ways, marketers shouldn’t make the mistake of approaching it like any other social network. The unique formats it offers are fundamentally different to the traditional display and video units available on the mobile web, in-app or on platforms like Facebook, and beyond the paid-for units, brands also need to carefully consider the presence they create on Snapchat in order to be successful.

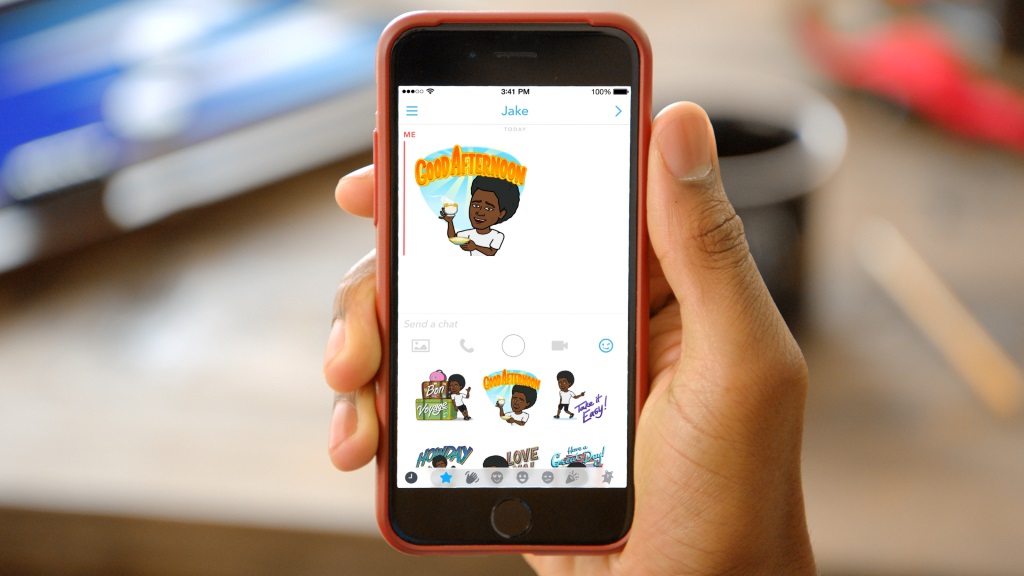

“Every social platform has a special DNA to itself,” said Thomas Cilius Hansen, CEO of Snaplytics, an analytics and marketing platform that specialises in Snapchat. “Snapchat is a much more fast-moving, candid view of whatever you’re doing right now, and you know it’s going to be disappearing any time soon, at least within 24 hours, so you’ll be less cautious about what you’re posting.

“We’ve talked to a few influencers, and they are very cautious of what they’re posting on Instagram, because they know it’s going to stick around, and they’re building a brand on Instagram posting a specific kind of content. They want to do more, post different kind of things, do different kinds of brand deals, but they need to move somewhere else and take that audience with them to somewhere where they can try things faster – and a lot of them are making that move to Snapchat.”

According to Hansen, what Snapchat have built over the course of 2016 is distinct from platforms like Facebook and Twitter, and marketers approaching it as a regular social network won’t be getting the most out what it can offer. If anything, Snapchat represents a mobile-first version of a more traditional channel: the television broadcaster.

“If you perceive Snapchat as a TV aggregator platform, then it all of a sudden starts to make sense,” he says. “When you publish a story, you’re a publisher. When you view other people’s stories, you’re a viewer. In between those things, you can inject ads, just like you can on any other commercial TV channel, and the strategic move they made some time ago, naming themselves Snap and saying they were a camera company goes pretty much hand-in-hand with the perception of them being a TV aggregator instead of them being just a social platform.”

Cutting the Chat

The rebrand in question came at the end of September, when the company made two big announcements. First was the new name, changing from Snapchat to Snap Inc to provide a little distance from its core product. The second was the introduction of a second product – a pair of smart glasses capable of taking pictures and video.

These ‘Spectacles’ weren’t designed as a large-scale product, but were instead meant to serve as yet another way of generating buzz around the company. Specially designed vending machines that would dispense the Spectacles appeared in spots around the US then vanished just as promptly, and Evan Spiegel, Snapchat’s CEO, referred to the glasses as a “toy” and an experiment rather than a fully-blown product line.

Even if the glasses weren’t designed to be Snap’s next great money spinner, the two changes did indicate the company was maturing, and most likely with a very specific goal in mind – an IPO that will most likely occur in the first quarter of 2017. By mid-November, the firm had filed papers with the SEC, and is reportedly targeting a valuation of anywhere between $25bn and $40bn. On top of that, the company is reportedly seeking to exceed $1bn in ad revenues over the course of 2017, as its expanded ad offerings lead to new brands and marketers coming aboard to take advantage of the platform’s unique capabilities.

“The things being posted on Snapchat, for most brands its very different than what you see on any other platform they’re active on,” said Hansen. “Especially when you look at what seems to resonate with the followers they have, it’s much more raw, candid, and it’s really giving something about themselves. Basically what Snapchat can do for your brand and your product is that this is your product’s storytelling platform. You can tell an actual story about your product.”

The Future of Snapchat

After such a dramatic year, the pressure is on Snap to continue its momentum and make good on its ambitions. An early IPO will generate both a lot of cash and a lot of good publicity, but securing a wider range of marketers and brands will be the more crucial goal in the long term. Like many mobile-first services, Snap also faces the difficult challenge of maintaining its core audience of ad-phobic millennials, and balancing that with increased monetisation and a growing presence for brands.

“Right now you can see Music.ly and Live.ly are really booming in terms of creating content,” says Hansen, addressing challenges to Snapchat’s position. “They’ve basically become the new Vine after that closed, so instead of just lip-synching to various songs, now you have sketches, etc going on at Music.ly, which is interesting. Will that take over? Probably not, but it’s still going to be different, and the really youthful segment seems to have fun there, and could move away.

“Secondly, I’d be curious as to how many brands are joining the platform, whether they want to be on Instagram Stories instead, or if Snapchat is creating channels they can use to engage with their audience, which leads directly to the third concern, which is that brands need to be acquainted with Snapchat in order to be interested in advertising on the platform.

“Hitting $1bn in ad revenues for 2017 is going to be a hard target, and they really need the marketing departments of various brands to see the potential, both in terms of being able to deliver metrics and ROI, and seeing the actual difference value in being present on Snapchat, and in order to do that, you pretty much need them to be on Snapchat.”

While Snap’s ascendency over the past year brings challenges, there can be no denying that the firm has built a unique proposition that stands alone in terms of mobile channels, both for users and brands. The way the company has evolved its offering over the past 12 months stands as a glowing example of how a mobile-first service can transform itself into a fully realised marketing platform, and whatever the future holds for the firm, it currently stands as a titan of the mobile world.

No comments:

Post a Comment