vice.com

The music press may not take Jacob Sartorius's music seriously, but the 14-year-old has roughly 10 million followers on the musical.ly app and now tours for his fans. Portrait by Jared Soares

Dae Dae is a 23-year-old rapper with a toothy grin and long, blue-dyed dreads that flap up when he dances. He grew up poor in Atlanta's Boulevard/Fourth Ward and started rapping at ten years old. When his father got locked up for selling drugs, he took a job pouring concrete and doing flooring to support himself and his family. It was while pouring concrete that he came up with the words for his debut single, "Wat U Mean (Family to Feed)," a song with a hook that summed up his reasons for being there: "Got a family to feed, they dependin' on me."

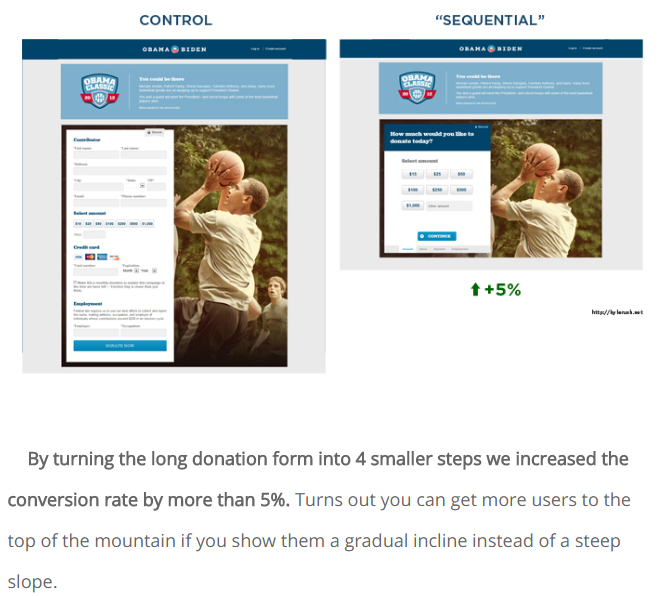

Less than a year later, he signed a record deal with in-demand producer Nitti Beatz and got to work promoting the track. When it hit the internet last April, the music video for "Wat U Mean" enjoyed modest success, while online clips by two prominent Atlanta dance crews—SheLovesMeechie and Team NueEra—earned the song 2.5 and 1 million listens apiece. By summer, the song was making the rounds on the radio, reaching number 7 on the

Billboard R&B/Hip-Hop Airplay chart on August 27 and 25 million hits on YouTube by September. According to Dae Dae, a catalyst for the song's success was musical.ly, a music video-production and sharing app that few people have heard about in the Atlanta rap world.

Approximately 50 million people under the age of 21—or roughly half of the teens and preteens in America—are on musical.ly.

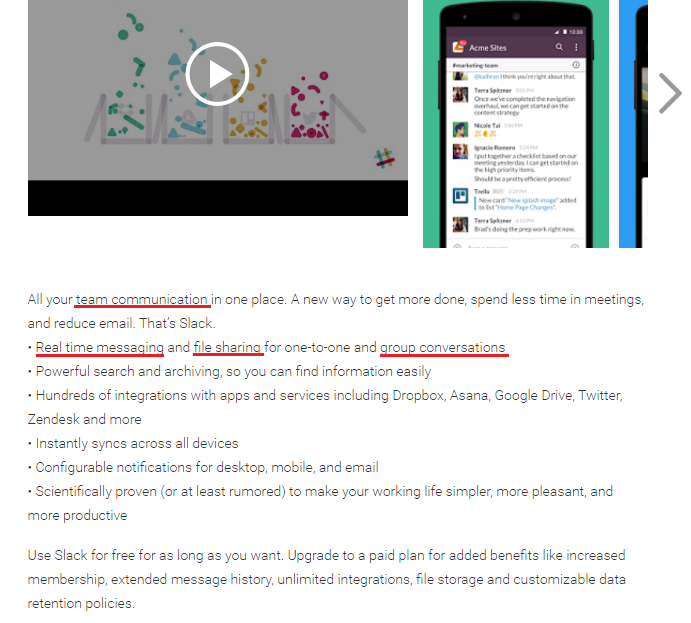

Musical.ly is both a utility app and a social network. Users select from a menu of their favorite songs, then record a 15-second video of lip-synching, dancing, or clowning around to the music. There is also an in-app livestreaming feature called live.ly. As with Instagram, its suite of editing tools and filters enables users to easily and speedily create content and then share it with their followers, who reward the videos they like with a dizzying proliferation of views, hearts, and comments. Musical.ly users who receive the most hearts over a given 24-hour period rise to the top of an in-app leaderboard displaying the most "popular" musical.ly users—dubbed "musers"—at a given moment. Of particular interest to young artists like Dae Dae, there's also a song chart, ranking the most popular songs on the app.

Approximately 50 million people under the age of 21—or roughly half of the teens and preteens in America—are on musical.ly, and a handful of that generation's most beloved viral stars got their start on the app. There's Baby Ariel, a 15-year-old Florida native who began uploading lip-sync videos to songs by Justin Bieber and Drake while living in her grandparent's house; as I'm writing this, she has 13 million followers on musical.ly, does national tours with other digi-celebrities, and makes money off of sponsored editorial on her YouTube channel. And there's Jacob Sartorius, a former child actor from Virginia who debuted his first pop single, "Sweatshirt," to his roughly 10 million followers on the app. By September, the song—a tune about the 14-year-old heartthrob offering to let a girl wear his sweatshirt in case she's not yet ready to kiss—had more than 26 million views on YouTube.

Musical.ly boasts more than 11 million video uploads per day from more than 120 million users worldwide; 64 percent of the app's American users fall within the coveted 13–24 demographic, and 75 percent are female. Hoping to capitalize on that audience, Dae Dae debuted a 15-second snippet of "Wat U Mean" on musical.ly in August; to promote it, he hosted an in-app contest challenging listeners to make a music video of themselves performing his signature dance, where he languidly swings his arms in the air to the song's staccato "Aye" shouts. Since its inception, the challenge has yielded a staggering 153,719 responses, with scores of newly won fans performing their own renditions of the "Aye" dance.

"I definitely did connect with a lot of people on musical.ly I wouldn't think even listen to rap music," Dae Dae told me via email. "This older guy made a video, and I was thinking he could be doing anything else with his time, but he took time out of his day to rock out to my song."

According to a representative from musical.ly, the app drove a major spike in YouTube views for "Wat U Mean" and more than doubled iTunes sales from one week to the next, all through outgoing links on his user-profile page. D.R.A.M., an up-and coming rapper from Virginia, who has worked behind-the-scenes with Rick Rubin, noticed something similar happening with his Lil Yachty collaboration, "Broccoli." After his team released the music video on YouTube in July, they discovered that the song had already been charting on musical.ly for months, garnering 30,000 videos without any direct promotional campaign. Today, more than 285,000 videos have been posted with #broccoli; thanks in part to the app, it was the summer's biggest sleeper hit.

Through musical.ly, Dae Dae and D.R.A.M. gained access to the sort of impromptu secondhand promotion typically reserved for artists who already have rabid fan bases (think Drake's "Hotline Bling" video, which spawned a wave of memes that further spread the song). Beneath musical.ly's ostensible function as a place where young people amuse themselves making videos for their friends, the app poses an eye-opening, potentially industry-disrupting question: Why try to promote your music all on your own when you can get fans to promote your work for you?

"Fans don't want to only receive new music; they really want to create and interact with this music," Alex Hofmann, president of musical.ly North America, told me by phone from the company's San Francisco headquarters. The soft-spoken German helms the company with Alex Zhu, a self-titled "designtrepeneur" from Shanghai whom he met while working as a marketing director at SAP Labs, a Silicon Valley enterprisesoftware company. Zhu has said he came up with the idea for a combined music-video app and social network while riding the train one day, watching a group of teenagers taking selfies and listening to music. A month later, in July 2014, he and Shanghai based co-founder Luyu Yang launched an early iteration of musical.ly in the iTunes app store.

Downloads were slow the first year. But in April 2015, after the company began allowing users to follow one another, favorite one another's posts, keep tabs on the highest-charting videos via a leaderboard, and remotely collaborate on videos via musical.ly "duets," things started taking off. By July 2015, the app jumped from 1,450 downloads a day on average to half a million and landed the coveted number one position on iTunes. By March 2016, according to a TechCrunch report, musical.ly had 60 million active users and $100 million in venture capital, at a $500 million valuation. Today, it employs around 100 employees in offices in California and Shanghai.

The music press has largely ignored musical.ly, likely because Baby Ariel and Jacob Sartorius, two of the app's most visible faces, seem more like vlogger-style internet personalities than serious musicians. But many of the big-name rap and pop stars—and the labels that sign these musicians—have been paying attention for months.

Musical.ly uses song snippets to entice users out of the app and to streaming sites where they can listen to—or purchase—the real thing.

Log on to musical.ly, and you'll find a selection of songs by Wiz Khalifa, Fetty Wap, and Ty Dolla $ign to choose from; each has run promotional campaigns similar to Dae Dae's. According to musical.ly, a campaign Arianda Grande did for "Into You" yielded 772,000 fan videos; Rihanna's #Work challenge generated 830,000 fan videos, which, per Hofmann, caused the hashtag for the song to start trending on Instagram. This summer, Hofmann also reported observing a direct, if delayed, correlation between songs charting on musical.ly and songs that began charting on

Billboard.

As Hofmann sees it, musical.ly's potential to transform the music industry stems from its emphasis on what folks in Silicon Valley call "digestible" content, using fragments of songs as advertisements for the whole. "It doesn't disrupt the flow on Spotify or Apple Music," Hofmann explained. In other words, musical.ly uses song snippets to entice users out of the app and to streaming sites where they can listen to—or purchase—the real thing. "What the industry [is realizing] is [that] secondary consumption leads to primary consumption," he explained. "We don't take a piece out of the pie with musical.ly. We actually make the pie a little bigger."

Musical.ly's in-app editing tools simplify producing and sharing 15-second videos, which are soundtracked by users' favorite pop songs.

Lyor Cohen, a storied music executive with experience running major labels like Island Def Jam and Warner Brothers, is one of many in the industry who stand to profit from a larger pie. In 2012, he co-founded 300, an independent record label synonymous with the viral successes of rappers like Fetty Wap, Young Thug, and Migos, with a professed mission to harness social media to transform the music business. In 2014, 300 announced a partnership with Twitter and gained unparalleled access to the social network's stockpile of music-related data in exchange for helping the company develop yet-to-be-unveiled tools for A&R and marketing professionals. Cohen only had complimentary things to say about musical.ly—in fact, his team encouraged Dae Dae and Nitti Beatz Recordings to try it in the first place.

"300 loves being the test-tube babies for innovations, particularly around products that incorporate music," Cohen told me by phone. He said Dae Dae's musical.ly campaign resulted in a "dramatic increase in streaming and sales," and that 300 plans to run campaigns for other artists on the label, including Young Thug and Brooklyn post-punk band Mainland. "Something they're hitting is very powerful," Cohen said of the app.

Sebastian Begg, an A&R and artist manager at Interscope Records, said he noticed success similar to Dae Dae's with BUNT., a German electronic-folk duo that launched a twangy comeback single, "Old Guitar," on musical.ly after some time out of the spotlight. By the end of the three-week musical.ly campaign, the band saw its Spotify listener base increase from 86,000 monthly listeners to 902,000. Begg wasn't entirely surprised; the MIT grad had been meeting with Hofmann since around the time musical.ly went number one in the app store. According to Begg, he'd advised Hofmann to develop musical.ly as a tool not only for amplifying preexisting stars but also for launching new ones. "If you can contribute in breaking an artist, you will be a lean-forward platform," he told me. "That means that instead of being able to react to pop culture, you will be able to progress pop culture."

Business Insider reported that musical.ly now offers its artists certain free-of-charge support services, such as connecting them with talent agencies, organizing meetups with fans, and even helping them to review some contracts. In June, news broke that musical.ly had signed a deal with Warner Music Group, home of Atlantic Records, Rhino, Warner Bros. Records, and many more. Ayal Kleinman, the vice president of marketing at Warner Bros. Records, said he was unable to comment on the specifics of the deal, but said that it enabled the company and its affiliate labels to freely license music to and promote music on musical.ly. Hofmann added, by email, that musical.ly has "formal relationships with all of the major record labels and music publishers," including Sony, Interscope Records, which is part of the Universal Group, and 300, which is distributed by Atlantic Records. When it comes to streaming sites like YouTube, iTunes, and Spotify, he wrote, "Musical.ly is in conversations with all three and will likely partner with one in the future."

But Kleinman said he sees the app less as a catchall marketing tool than a way of targeting a very specific demographic. "I know that there's a sweet spot in the demographics for the app, and it's definitely younger kids," he said. "In terms of the repertoire that we choose to promote on the app, it's going to be stuff that speaks to that audience. We're not putting more mature material on there."

Beyond the question of demographics, musical.ly has limitations. Its emphasis on creating viral content out of hooks lends itself more to accessible pop fare than to the stylistically adventurous corners of music creation—a reality reinforced by the leaderboard and song-chart features, which suggest that the most popular content is what matters the most. Musical.ly may also be taking a grassroots promotion method and stripping the democracy out of it. If social media's biggest contribution to the industry has been to level the musical playing field, allowing artists without label backing to market their output themselves, then an app running promotional deals with the majors runs the risk of using the veil of digital meritocracy to mask a system that is innately rigged. Viewed in the most cynical light, musical.ly could also be seen as a vehicle by which major labels can manipulate unsuspecting teens—drawn in by the app's entertainment value—to run their promotional campaigns for them.

Jacob Sartorius, a former child actor from Virginia who debuted his first pop single, "Sweatshirt," to his roughly 10 million followers on the app. Portrait by Jared Soares

Still, Hofmann stressed that he sees musical.ly more as a "family" than a service. "Our goal is to have a platform that connects millions of people and allows them to express themselves," he said.

These days the company is focused on expanding internationally. Of the territories musical.ly is in, it's seen strongest growth in Germany, the Netherlands, France, Mexico, Indonesia, and the Philippines; for countries with poorer-quality internet, the company has even introduced a lower-bandwidth version called musical.ly lite. Hofmann told me the company now allows fans to compensate artists directly, by using live.ly to digitally deliver small sums of money—or "gifts"—to the artists they love.

In September, Hofmann's employees at musical.ly North America were in the process of packing up their desks. This fall, they'll relocate to a new office in Los Angeles, in order to work more closely with the entertainment industry. It's a move that feels symbolic of the company's rapid rise from a tech-world startup to music-industry power player, like Apple and Spotify before it. Still, the full scope of its impact on that business remains just as mysterious as the day when Dae Dae woke up, opened the app, and saw thousands of people from around the world dancing to and lip-synching his song.