In the consumer mobile space, game publishers have traditionally generated the most revenue, but a new app monetization report indicates app makers are catching up.

Revenue from non-game apps is growing at a faster rate that game-generated revenue, according to a report from analytics firm App Annie titled "App Annie App Monetization Report: Publishers to Earn $189 Billion from Stores and Ads in 2020" (free PDF download upon providing registration info).

App Annie provides free and commercial analytics products that gather information on metrics such as app downloads, revenue, demographics and usage across countries and app stores. To provide publishers with guidance about market opportunities, it creates periodic reports highlighting insights from collected data.

The increasing revenue generating opportunity from non-game apps is one such insight.

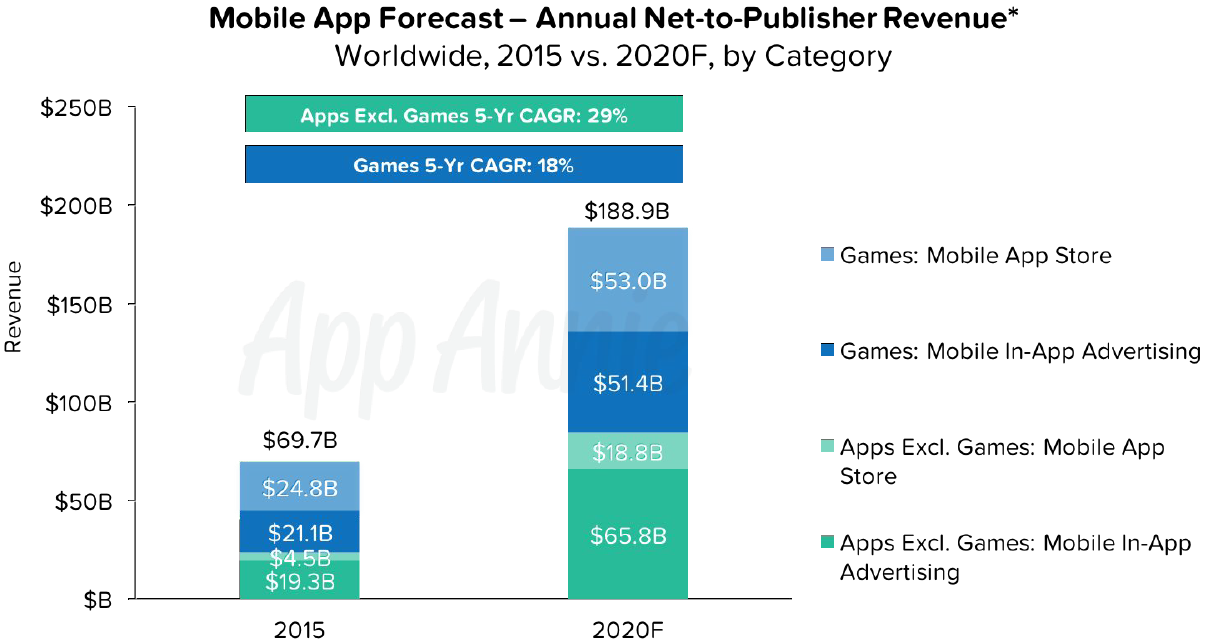

"Although games will continue to drive the majority of combined in-app advertising and app store revenue through 2020, its share will decline from 66 percent to 55 percent as apps grow at a faster rate," the company said in its report, published last month.

"In fact, combined net revenue for apps is projected to more than triple over the forecast period," the report continued. "While game publishers drive the majority of ad spending, much of this spend is allocated to social and video platforms, driving strong revenue growth for apps. In addition, the increasingly popular subscription-based revenue models will contribute to store revenue growth."

Other findings echo the results from previous studies, such as this one last year that indicated the Android-based Google Play store has more inventory and a wider reach, but the iOS App Store provides the most revenue because it attracts higher-end users with more disposable income. That still holds true, according to the new report.

"While Android leads worldwide downloads by a factor of 7:2 due to its dominant installed base, iOS leads on revenue by 3:2 due to its more affluent customer base," the report said. "iOS will maintain its lead over Google Play and third-party Android through 2020; though the latter two are projected to grow faster."

Growth in "third-party Android" stores is primarily driven by "highly fragmented app store market" in China, a country that App Annie has long said is of utmost importance to app publishers.

Other highlights of the report identified by the company include:

- Combined worldwide in-app advertising and net-to-publisher app store revenue is forecast to grow by 2.7x -- from $70 billion in 2015 to $189 billion in 2020.

- In-app advertising and freemium will continue to dominate other business models and subscriptions will continue to be an increasingly important type of in-app purchase.

- The Americas, Asia-Pacific (APAC) and "Europe, the Middle East and Africa" (EMEA) will experience significant revenue growth from 2015 to 2020, with China driving APAC's particularly strong growth.

The main conclusion, however, might be that the expanding mobile space will leave plenty of leeway for publishers to make money, even amid the longstanding problems of app discoverability and maintaining user engagement.

"The huge revenue growth across categories and business models demonstrates that there will be a variety of opportunities for app developers and marketers," App Annie said. "They will be free to choose the avenues that best fit their apps and strategy rather than having to conform to a narrow set of growth areas."

No comments:

Post a Comment