Combining demographics with account level insight, transaction history and locational data can make your mobile banking app your most effective and efficient sales channel.

With the overwhelming acceptance of the smartphone and the increasing use of mobile banking applications, progressive financial institutions have moved beyond traditional marketing channels and are leveraging the mobile phone as an important sales channel. No longer just focusing on the mobile Web, integrating marketing messages within the mobile banking app itself offers a better opportunity to target the right audience at the right time.

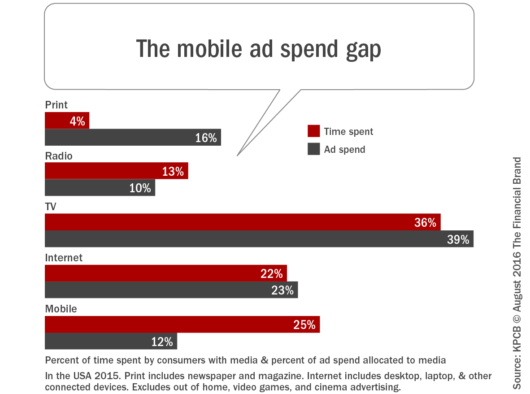

For years there’s been a disparity between the amount of time people spend on their mobile device and the actual ad dollars allocated to this medium. No place is this more true than the banking industry, where there has been a hesitancy to use this powerful channel beyond basic banking tasks. It is expected that this gap will narrow as bank and credit union marketers become more adept at using mobile to reach their audience.

The primary reason for the increased focus on in-app mobile banking offers is that this channel can provide a solution that can capture the targeted consumers’ attention and encourage them to interact without interrupting their mobile banking transaction.

“In-app mobile ad spend is really the future of the mobile advertising category. Considering that people with access to a smartphone or tablet now spend an average of three hours on them per day and 84% of all smartphone time is spent in-app, in-app engagement is increasingly critical for brands, advertisers, marketers, and agencies,” says Chad Gallagher, director of mobile at Advertising.com.

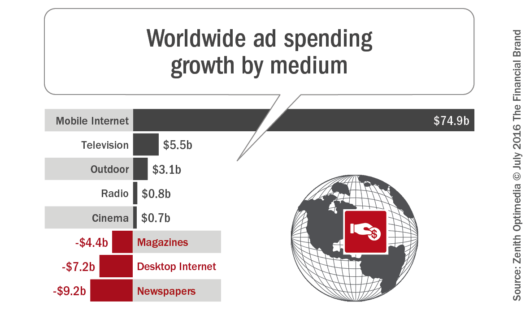

Compared to other marketing channels, it is estimated that the growth of mobile advertising will increase significantly more than any other channel, While the banking industry doesn’t anticipate this significant of a shift from traditional channels, it should be noted that the marketing world has noticed the sales potential of connect with consumers on their channel of choice.

Why In-App Mobile Banking Marketing Works

In-app mobile banking marketing works well because it combines the power of rich customer insights already on file with location data, which allows a bank or credit union to better understand context and increase engagement. So, while the best financial marketing can leverage both internal and external insights such as demographics, account ownership, balances and behaviors, in-app mobile banking marketing can add an additional data layer that can be delivered at the exact time of need.Moreover, in-app mobile marketing also improves tracking, attribution and targeting, since a marketer can pinpoint exactly when and where an offer was clicked as well as what occurred before and after the engagement. This insight can be used to improve the offer selection and delivery via the mobile channel while also helping the targeting of other digital and traditional channels.

Finally, unlike most other channels, financial marketers can use in-app mobile marketing to determine if the digital sales process is overly complicated, causing abandonment of engagement and the loss of a potential sale. By understanding the stage of the sales process that causes abandonment, marketers and product managers can simplify the process and improve sales effectiveness.

Pre-Login Sales Opportunities

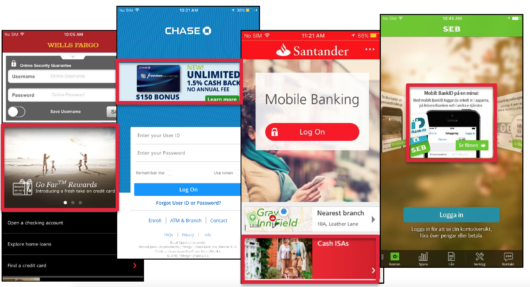

According to the Insight Series Report, “Sales Opportunities in Mobile Banking,” done by Mapa Research, which researched 44 banks and 8 other financial service institutions across 8 countries, there are many places within a mobile banking app where marketing can occur. Some brands use the pre-login area for promotional messages, while the activity in the post-login space appears to have more potential with more variety of engagement toolsThere has been a significant increase in the number of banks using the pre-login space to promote new products and services, with 60% of financial institutions monitored by Mapa using some form of a promotional banner that appears behind or on the main login screen. Given that the log-in screen is seen most often by the customer, this is an obvious space to use for promotional banners.

Mapa warns that the generic nature of most banners can make them feel like internet pop-up ads and can detract from the aesthetics of the app and be a deterrent to those customers who are particularly sensitive to the feeling of being pushed to buy. To avoid this issue, some banks are using public-site product menus on the pre-login page, including market trends, community events, etc. In fact, 45% of organizations monitored offer more than just promotional banners on the log-in page.

Other strategies used by financial institutions as part of the pre-login process include:

- Linking social media

- Appointment scheduling

- Tools and calculators

- Rewards/Offer section

Post-Login Sales Opportunities

The main areas for post-login promotional messages are alerts and push notifications (managed in the app but received at any time). Both approaches are designed to keep the brand in the customers mind. Some providers are even using the customer spending and account activity to send timely notifications.Beyond simply using alerts to warn a customer about a recent transaction or when an account falls below a certain threshold, organizations are also using these types of post-login messages to inform about a new product or service or to encourage the use of rewards. For instance, Bank of America uses alerts to inform customers about the status of their BankAmeriDeals rewards.

Post-login notifications are primarily used to engage with customers regarding the activity on their accounts. Not only can these notifications encourage customers to think more actively about their finances, they can also provide recommendations about services that could assist in these efforts.

In order to meet “unmet needs”, providers are making use of customer data to get to know their customers. Using this data wisely allows brands to deliver promotions tailored to each individual.

According to Mapa, “Every push creates trust between the user and the app because it delivers immediate value. Due to the trusting nature of this relationship, if the customer was to then be sent a notification alerting them to a new product that could further improve the health of their finances, the customer is likely to react positively to this, and see it as an extension of the existing relationship instead of an obvious sales push.”

Interstitial Messaging

Financial institutions are not only focusing on the pre- and post-login opportunities to market products and services. Some organizations are leveraging the space between between pre- and post-login for using interstitial messaging. These are screens that pop-up after the consumer has logged in but before they can continue their transaction.A well done interstitial only causes a minor interruption in experience, with the customer having the option to skip the message with a simple ‘swipe’. This has the benefit of balancing experience with effective selling.

This technique can be used to inform the customer about a recent update of the app, a major product announcement, a community event, etc. Some organizations provide the opportunity to ‘see more’ before they move forward with their transaction. Although ad formats are less important than relevancy, research shows that in-app banner ads don’t generate as much revenue as personalized ads and both of these formats are much less effective than an interstitial.

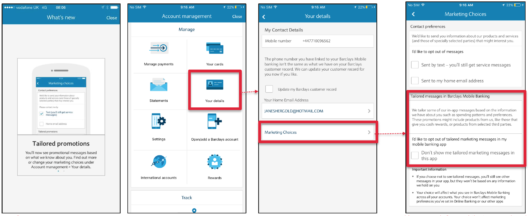

Tailored Marketing Messages

Optimally, customers should receive marketing messages based on their spending habits and marketing preferences. The latter is an important point, since even tailored messages can become intrusive if received too frequently or in a format/channel that the customer is not comfortable with. As a result, some banks provide customers with the option to control how and when they receive marketing messages.Banks and credit unions can also tailor product offerings to specific consumers. such as loans with predetermined values based on consumer spending data. “By using customer data that the bank already has access to, the bank can expedite the application process and significantly reduce the likelihood that a customer would go looking elsewhere when thinking of applying for a similar product,” states Mapa.

Done effectively, selling within the mobile banking app dramatically reduces the inconvenience of applying for financial products or services through other channels, meaning that the number of customers that abandon the process and ‘quit before the check-out’ is lessened considerably.

Mapa research manager Jess Morley comments: “Consumers and financial solution providers have become wary of the ‘hard sell’ when it comes to financial services. As a result, there has been a move towards selling by identifying unmet consumer needs, using data to identify products that could improve a consumer’s financial situation.”

He continues, “When products are suggested to consumers in this evidenced-based manner within a mobile app, the sale seems less forced and consumers are more willing to trust the suggestion. This is a sales technique that banks have adopted from e-commerce providers like Amazon, which provides customers with a list of suggested products based on their browsing history.”

At the end of the day, it is best to target the best way possible and experiment with all kinds of ad formats and placements. Try pre-login and post-login and use banners, lists, interstitials and maybe even a video. Then, conduct A/B testing them.

While the placement and ad format may be important, making sure that an ad is relevant to the user while simultaneously presenting it in an non-invasive manner is more important. It is the relevancy of the message that makes it compelling as opposed to the ad type.

No comments:

Post a Comment