thehindubusinessline.com

Catching them young: In the hunt for customers and effective engagement, marketers are training their sights on mobile game-obsessed millennials

Mobile games are big business, and advertising is turning out to be a major source of revenue for gaming companies. Chinese internet giant Tencent Holdings managed to surpass Facebook in valuation a day after breaking the $500-billion barrier. Mobile and online games are a key part of the business for Tencent, not well known outside China. In India, WestBridge Capital-backed Nazara Technologies, a mobile games company, has had IIFL Special Opportunities Fund acquiring a minority stake for around ₹330 crore.

Nazara Technologies recently teamed up with Pokkt, a smartphone ad platform for mobile games, to develop a campaign for Nazara’s popular game based on the ‘Chhota Bheem’ character. The duo partnered with Reckitt Benckiser’s Dettol. The product was integrated in the game to enhance user experience as well as brand visibility. Bheem washes his hands at regular intervals, to keep germs at bay, aligning with Dettol’s core positioning.

MONETIZING WIN-WIN

“Mobile games like Candy Crush, Temple Run or Angry Birds are passé,” says Rohit Sharma, Founder, Pokkt. “They are free to download and the game developer only makes money when a person buys some coins to go to the next level.”To get the cash registers ringing integrate brands into the games, he says. Most people don’t buy coins and abandon the game altogether. When brands get into the act, they offer incentives that help players get to the next level, and people purchase the brands.

According to market research and advisory firm Gartner, 46 per cent of global app users paid for their apps, and download numbers were 268 billion by the end of 2016, generating $77 billion in revenue. “In-app purchase is huge in America, China and Japan, though it has just started creating some steam here,” says Sharma.

With over 12 million active users, of which eight million are children, the gaming company Nazara decided it was time to reach out to its audience in an innovative manner. Getting rid of the intrusive banner ads, which most players cannot wait to close, Pokkt helped the company integrate several FMCG brands into its mobile games.

Other than Dettol, Pokkt has integrated brands such as Flipkart, Myntra, ITC, Britannia, Boost and Dabur in other mobile games. “We cater to most of the top global games. Some games like Subway Surfers, Temple Run and Angry Birds will never die or go out of fashion, for the publisher will keep on creating updates. Most game developers are keen on introducing content that is sticky and engaging. So the new levels and new interactions are where brands can move in and monetise,” he adds.

Whether it’s placing their names or logos inside the games to catch the attention of the players while using the app, or having them engage with it actively, advertising in gaming has become a preferred choice for brands, says Sharma, adding that a mobile game being a more interactive medium makes for more brand visibility as users are engrossed in the experience.

Reliance Games, a part of Reliance Entertainment - Digital, of the Anil Dhirubhai Ambani Group, teamed up with GoPhygital, a Mumbai-based firm, to announce its foray into the fast-growing augmented reality (AR) and virtual reality (VR) space.

The duo are to develop games, apps, and experiences. Amit Khanduja, CEO, Reliance Entertainment – Digital states the company will continue to push the boundaries for apps and games with AR and VR. “We are at the threshold of a big revolution in how digital content will be consumed,” he added. GoPhygital is working on an AR-based casual game that leverages Apple’s ARKit technology, to be launched soon by Reliance Games.

POISED FOR BIG GROWTH

Ninad Chhaya, Co-Founder and COO, GoPhygital, added that mobile apps and games have become an integral part of most consumers’ lives. “With mobile devices getting more powerful year after year, mobile games are set to change the gaming landscape,” he said.

Referring to a recent study done by market intelligence company Newzoo, Chhaya said by 2020, games on smartphones and tablets will capture 50 per cent of the global games market. “These stats are incentives for companies to take the leap and start investing and advertising in mobile gaming apps,” he pointed out.

Johnny Li, Vice-President, Cheetah Mobile, APAC and Global Performance Business, says the advent of 4G and surge in smartphone usage has resulted in a boom in mobile advertising. “The market potential, however, is still relatively untapped due to misconceptions about the industry, such as its suitability for businesses beyond apps and performance marketing,” he adds.

Cheetah Mobile is a Chinese mobile internet company with operations in India. This March, Cheetah Mobile rebranded its ad division in India as Cheetah Ads. It works together with major advertisers, developers and publishers. Li noted that ad fraud was another concern globally, “but is something the entire industry is trying to combat. With a localised approach, Cheetah Ads will continue to invest in the emerging mobile ad space in India and make the advertising experience smarter and better for brands as well as for users.”

InMobi, a mobile advertising platform, has similar ideas. Last year, it teamed up with Tapjoy, a company that deals with mobile advertising and app monetisation, to monetise Tapjoy’s inventory in India.

Tapjoy has 40 million unique users in India across popular mobile games such as 8 Ball Pool, Criminal Case, Shadow Fight 2, and Subway Surfers. An official said advertisers will be able to expand their reach beyond InMobi’s 135 million unique devices in India by accessing Tapjoy’s India inventory.

According to a report by Nasscom, mobile game downloads are expected to grow at a CAGR of 58 per cent over the next five years, touching an estimated 5.3 billion downloads in 2020.

Capitalising on this trend and cricket fever is Gamesbond, a mobile games marketplace and a part of Mauj Mobile. With 20 million monthly active users and over 65 million annual downloads, the company launched Sprint Cricket, developed in partnership with SuperSike Games, a Delhi-based game development studio. As mobile game app developers continue to play a crucial role in creating a vibrant market for content, their monetisation strategies focus on new forms of advertising that go beyond the traditional banner ad. “Mobile games have been gaining in popularity due to the advancement in mobile technologies, internet penetration and the large increase in the number of smartphone users,” said the official.

Pokkt’s Sharma says India has emerged as one of the top five countries globally for online mobile gaming, and adds that India’s hypergrowth in game downloads and 30 per cent increase in time spent on mobile games are early indicators that monetisation is set to be the next area of growth.

Last year’s Nasscom Game Developer Conference had also noted that Indian mobile gaming revenues are set to reach $1.1 billion by 2020.

With millions of apps being installed in a single day across all genres, Sharma insists brands would find more value in advertising within the app “as it is more measurable and there are third party tools gaining precedence for in-app advertising, which also helps the brand to get more eyeballs.”

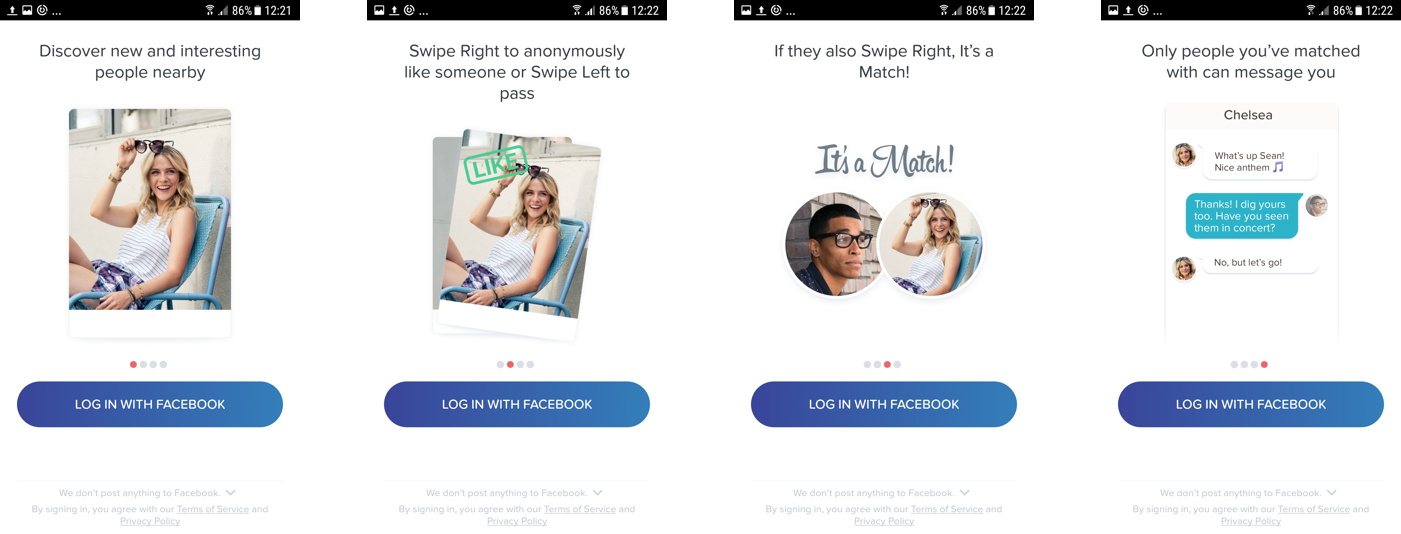

Tinder was launched in September 2012 but didn’t grow much in the first few months.

Tinder was launched in September 2012 but didn’t grow much in the first few months.